Today people shop and buy differently thanks to the internet – unsurprising. However when two landmark studies quantify the process of shopping, some surprises that have big implications to marketing emerge. Let’s start with the old thinking to better understand what’s new. (Will it be “Fun”? Of course it will. ;)

BOTTOM-LINE: Marketers need to understand how people shop today and align their activities accordingly to be most effective.

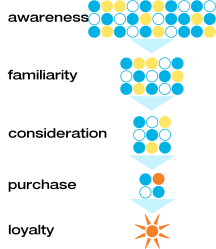

the traditional funnel

This outdated model was developed before the prevalence of the internet when there was a barrier to information. Consider: Consumer Reports was a trip to the library and advertising was actually considered somewhat trustworthy.

1 – A person will “recognize a need” and actively begin shopping.

2 – People start with a large number of potential brands in mind. Being in this “Top of Mind” group of brands is the pay-off for “branding advertising”.

3 – Next people enter into a consideration phase. Here they compare features…no make that benefits – and methodically subtract brands in consideration until… This is when marketing pummels people with “push” advertising telling them why their brand is best…and it worked for a long time.

4 – Eventually, people emerge with a decision and purchase .

McKinsey & Co.’s Consumer Decision Journey

2008 – 20,000 consumers – 5 industries – 3 continents

You have to love our friends at McKinsey & Company as they always go BIG. In this study, McKinsey illustrates exactly why the Traditional Funnel no longer applies and how marketing should purposefully address the different stages of the consumer decision journey.

It begins with triggers that set people on the path of purchasing. (There are huge ideas here for real estate… ;)

STAGE 1 – Initial Consideration. People start off with certain brands in mind. Interestingly, there are not that many brands included in this initial consideration set. (Ranking the highest was Autos at only 3.8 brands.) (Getting into the Initial Consideration set is the pay-off for all that “branding advertising” marketers invest in. It seems wasted, until people are triggered and then remember you. However, this is only the beginning. If your marketing stops here – OUCH!)

STAGE 2 – Active Evaluation. Here people add and subtract brands as they evaluate what they want.

People aren’t just starting with a fixed pool of brand options and then whittling it down from there. They are starting with a small net and then expanding it to consider more brand options. (It’s in Active Evaluation that a new brand can enter in and knock an Initial Consideration competitor out of the running. If you’re not active in Stage 2…)

And to make things even more interesting, 67% of the information used in Active Evaluation involve consumer-driven marketing touchpoints (reviews, recommendations, past experiences, in-store interactions). Only 33% is company-driven. (So marketers would be well-advised to learn how to influence those consumer-driven touchpoints. Content marketing anyone? Social Media anyone? Experience Focus perhaps? Are you budgeting appropriately?)

STAGE 3 – Moment of Purchase. Ultimately, people emerge with a decision and purchase. It may be made on-line, in a store, or in a sales office.

STAGE 4 – Postpurchase Experience. After experiencing what they purchased, people will use the information to generate more consumer-driven information and the cycle continues.

Google’s Zero Moment of Truth.

2011 – 5,000 consumers – 12 industries – 1 continent

Rather than approach the purchasing decision journey from the consumer behavior perspective, Google look’s at the shopping dynamic through the lens of a marketing model by P&G.

Stimulus. Mike is watching some history show and sees a commercial for a camcorder. He thinks, “That looks good.”

Shelf (First Moment of Truth). He goes to his favorite electronics store, where he sees a terrific display for that same camcorder. The packaging is great. A sales guy answers all his questions. He buys it.

Experience (Second Moment of Truth). Mike gets home and the camcorder records brilliantly, just as advertised. A happy ending.

(This is a very MadMen’esque model in my opinion.)

Now Google’s study identifies a fourth shopping step and shows “where influence takes place as shoppers move from undecided to decided.”

STEP 1 – Stimulus. Something appealing prompts people to start on the path to purchasing.

76% of the shoppers said that Stimulus activities shaped their decisions. Topping the list of information shoppers sought out (or prompted them) are:

| Saw advertisements on television | 37% | Read information in an email received from a brand/manufacturer | 23% |

| Received mail at home from a brand/manufacturer (e.g., catalogue, brochure) | 31% | Noticed advertising while browsing online | 22% |

| Saw an ad in a newspaper/newspaper insert | 29% | Received mail at home from a store/retailer (e.g., catalogue, brochure | 22% |

| Read newspaper articles/reviews/information | 28% | Watched a TV show that featured the product | 21% |

| Read magazine articles/reviews/information | 27% | Saw an ad on an outdoor billboard | 16% |

| Looked at/read magazine advertisements | 24% |

(Candidly for real estate, I’m on-the-fence as to what this really says and am more drawn to McKinsey’s concept of a “Trigger”. However, this does speak to getting into the Initial Consideration set. Also, as much of this list revolves around traditional interruption marketing, make sure that your efforts are not traditional and cause a reaction. Safe…is oh so risky.)

STEP 2 – Zero Moment of Truth [ZMOT]. This is that ” grab the laptop/tablet/phone moment” when people start researching options.

84% of the shoppers said that ZMOT activities shaped their decisions. Topping the list of information shoppers sought out are:

| Searched online, used search engine (net) | 50% | Read product reviews or endorsements online | 31% |

| Talked with friends/family about the product | 49% | Sought information from a retailer/store website | 22% |

| Comparison shopped products online | 38% | Read comments following an article/opinion piece online | 22% |

| Sought information from a product brand/ manufacturer website | 36% | Became a friend/follower/”liked” a brand | 18% |

(Note: Hubspot puts search engine use in purchase research at 73% and strongly favors organic over PPC.)

STEP 3 – First Moment of Truth [FMOT]. This is that last metaphorical in-store deciding-moment of staring at a shelf and making the final choice.

77% of the shoppers said that FMOT activities shaped their decisions. Topping the list of information shoppers sought out are:

| Looked at the product package in the store | 41% | Looked at signage/display about the product in the store | 30% |

| Read brochure/pamphlet about the product in the store | 37% | Talked with a customer service representative on the phone | 20% |

| Talked with a salesperson or associate in the store | 33% | Tried a sample/experienced the product in a store | 19% |

STEP 4 – Second Moment of Truth [SMOT]. The experience of what they purchased. From that people will use the information to inform others..and the cycle continues.

————–

LAST THOUGHT: Active, uncontrolled research now drives the critical stage of the shopping process and marketers need to respond to that.

Worth a Visit: McKinsey & Company’s Consumer Decision Journey

Thanks so much for stopping in and I’d love to hear what you think. Comment here or give me a shout on Twitter at @HollyHM2. Until next time – Cheers.

2 thoughts on “how people really shop and a few marketing insights”

Holly, You have an amazing way of presenting the process. I need to talk to you. Will be in touch. Kimi

Thanks Kimi! Talk with you soon -Holly

Comments are closed.